The liquidity coverage ratio and its implementation in the Czech Republic

The Basel III regulatory concept introduced new liquidity requirements. One of those new prudential requirements is called “Liquidity coverage ratio” (hereinafter “LCR”). According to the EU regulation No 575/2013 (the so called “CRR”) a general LCR requirement in Article 412 is to be respected from 1 January 2014. Institutions shall hold liquid assets, the sum of the values of which covers the liquidity outflow less the liquidity inflows under stressed conditions. The purpose is to ensure that institutions maintain liquidity buffers to face any liquidity imbalances over a period of 30 days.

However, the detailed rules for the calculation of the LCR are set out in the Commission delegated act No 2015/61 (hereinafter “DA”).

See http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32015R0061

EU implementation of LCR is comparable to Basel international framework but takes into account Union and national specificities. The CRR in Article 412(5) and the DA in Art 38(2) introduce a discretion which allows that Member States or competent authorities may require a higher LCR before the LCR is fully introduced at a rate of 100% in 2018. Otherwise, a standard phasing-in period applies according to Art 460 CRR and Art 38(1) DA.

The Czech National Bank informed on 1 June 2015 that it will retain the standard phasing-in period. Furthermore, the CNB specified that minimum required reserves will not be eligible for the LCR purposes. The CNB also declares its intention to issue official information that will define the exposure to the CNB eligible for the LCR purposes and will specify repo transactions treatment. The CNB has not yet determined any additional liquidity outflow rates for other products and services according to Art 420(2) CRR and Art 23 DA.

See (in Czech only): http://www.cnb.cz/cs/dohled_financni_trh/legislativni_zakladna/banky_a_zalozny/sdeleni_o_pristupu_cnb_k_implementaci_ukazatele_kryti_likvidity.html

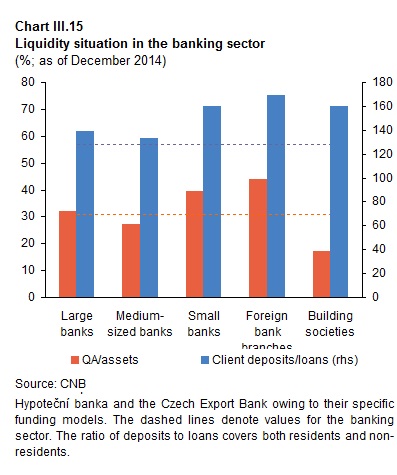

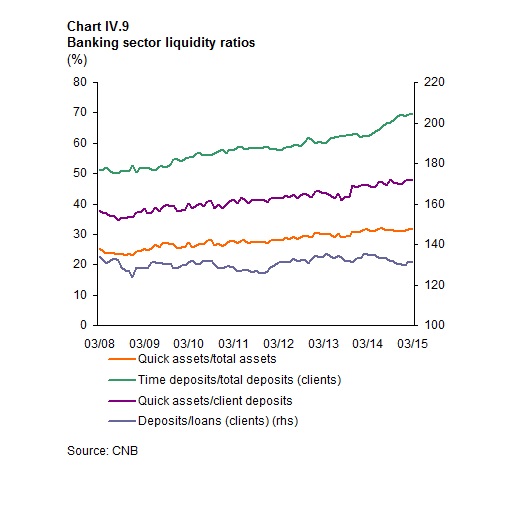

The Czech banking sector has long had a good liquidity position. The current situation may be seen in the following graphs published in the CNB Financial Stability Report 2014/2015. http://www.cnb.cz/en/financial_stability/fs_reports/fsr_2014-2015/index.html#3

© 2024