Mortgage lending value and EBA's opinion

Mortgage lending value (MLV) is defined in Article 4 (1) (74) Regulation (EU) No 575/2013 (CRR) and „means the value of immovable property as determined by a prudent assessment of the future marketability of the property taking into account long-term sustainable aspects of the property, the normal and local market conditions, the current use and alternative appropriate uses of the property“. The MLV must be distinguished from the market value (MV) which is also used for the purposes of immovable property and is defined in Article 4 (1) (76) CRR. While MLV represents a long-term and prudent value of the property, MV represents an assessment at the valuation date.

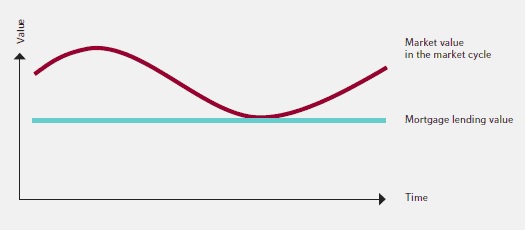

The difference between MLV and MV may be demonstrated on the following graph.

The MLV concept is a single concept used in several areas of the CRR, specifically in:

- the credit risk area,

- the credit risk mitigation framework,

- the large exposure regime, and

- the covered bond preferential risk weights indirectly.

The CRR enables in the first three areas both the use of MV and MLV.

As regards the credit risk area, the valuation of immovable property has a direct impact on risk weighting under the standardised approach for credit risk (STA) according to Articles 124 – 126 CRR and thus on the capital requirements. The part of an exposure which is fully and completely secured by a mortgage on immovable property may use the preferential risk weights according to CRR (i.e. 35 % for exposures secured by mortgages on residential property and 50 % for exposures secured by mortgages on commercial property) if not otherwise decided by the competent authorities. In order to be considered fully and completely secured an exposure must fulfil certain qualitative and quantitative conditions. Among others, it may not exceed 80 % of the MV or 80 % of the MLV in the case of the residential property and 50 % of the MV or 60 % of the MLV in the case of commercial property. Thus for the exposures secured by the mortgage on commercial property it makes difference whether the MV or the MLV is used for valuation.

Similarly, the difference between MV and MLV plays role in the large exposure regime. According to Article 402 CRR the exposure value that is subject to large exposure limits may be reduced by 50 % of the MV or 60 % of the MLV if certain conditions are met.

According to Article 124 (4) CRR the EBA has the mandate to develop the draft Regulatory Technical Standards (RTS) to specify the rigorous criteria for the assessment of MLV. In this context the EBA published on 5 October 2015 an Opinion on MLV addressed to the European Commission. In this Opinion the EBA specifically deals with possible unintended consequences that a harmonised definition of MLV across the CRR might have on the EU covered bonds market if this harmonised definition was used for the valuation of covered bond collateral in order to meet the eligibility for the preferential risk weights according to Article 129 CRR (i.e. in the area 4 mentioned above). The EBA, therefore, advises the Commission that the scope of RTS on MLV is limited to the areas 1 – 3. In the EBA´s opinion any aspect of harmonising the valuation practices in covered bond markets could best be considered as part of a more comprehensive review of EU covered bond frameworks.

The EBA also stresses that further clarification is necessary on when MV and when MLV is to be applied for the valuation of immovable property collateral. Particularly, it is unclear whether immovable property collateral can be valued by the MV after the RTS on MLV is adopted and whether this option is for the institutions or the Member States. The EBA is of the view that the Member States should specify the use of the MLV principle.

See https://www.eba.europa.eu/-/eba-seeks-legislative-clarifications-on-mortgage-lending-value

© 2024