EBA Guidelines on the definition of default

On 22 September 2015 EBA launched a public consultation on its draft Guidelines on the application of the definition of default (hereinafter “Guidelines”). The consultation will run until 22 January 2016. As the definition of default is a very important issue and its change might have significant impact on some institutions the EBA simultaneously launched a Quantitative Impact Study (QIS) which should test the impact of the changes brought in the draft Guidelines and in the draft Regulatory Technical Standards (RTS) specifying materiality threshold for credit obligations past due. The draft RTS were already consulted and consultation period ended in January 2015. The EBA mandates to issue the RTS and the Guidelines are stipulated in Article 178 of Regulation (EU) No 575/2013 (CRR).

In the past differing practices of institutions as regards the definition of default were identified and thus the objective of these regulatory products (RTS and Guidelines) is to harmonize those practices and to increase the comparability of risk parameter estimates and own funds requirements, especially as regards IRB models for credit risk. Nevertheless, the definition of default is relevant also for institutions using standardized approach. EBA also expects that it will help reduce the burden of compliance for cross-border groups.

The draft Guidelines provide detailed guidance on the application of various aspects of the definition of default, mainly:

- past due criterion as an indication of default,

- indications of unlikeliness to pay,

- specific aspects of the application of the definition of default for retail exposures,

- application of the default definition in a banking group,

- treatment of external data and

- criteria for the return to a non-defaulted status.

One example of the changes may be the new definition of technical default. It includes one of these situations which should not be taken as defaults:

- The identification of default results from the error in data or IT systems of the institution, including manual errors of standardised processes but excluding wrong credit decisions;

- The required payment has been made by the obligor before the relevant days past due criterion including the materiality threshold has been breached but default has been identified as a result of long payment allocation process within the institution.

Another example may include the distressed restructuring. The Guidelines specify that distressed restructuring should be considered when forbearance measures have been extended towards a debtor as specified in the ITS on forbearance and non-performing exposures.

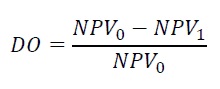

The default is classified when forbearance measures are likely to result in a diminished financial obligation (DO). This should be based on the comparison between the net present value of expected cash flows before the changes in the contract (NPV0) and net present value of the expected cash flows based on the new arrangement (NPV1), both discounted using the original effective interest rate as expressed in the following formula:

If the diminished financial obligation exceeds a certain threshold the exposure should be classified as defaulted. The threshold should be set by institutions but should not be higher than 1 % as currently proposed in the draft Guidelines.

If however, the diminished financial obligation does not exceed the specified threshold still such exposures should be assessed for other possible indications of unlikeliness to pay. The indications of that may especially include irregular repayment schedule, e.g. balloon payment at the end of the schedule.

The draft Guidelines are available at: http://www.eba.europa.eu/regulation-and-policy/credit-risk/guidelines-on-the-application-of-the-definition-of-default

The related draft RTS on materiality threshold can be found here: http://www.eba.europa.eu/-/eba-consults-on-materiality-threshold-of-credit-obligation-past-due

© 2024